Explained: Why India is well deployed to deal with Trump’s tariff and negative effects of top causes

US President Donald Trump is interrupting the world economy with his mutual tariff – but India is not only deployed against the adverse effects of these tricks, but can actually be able to take long -term advantage from the high duties of America, Moody’s said in its latest report.Moody’s has stated that India’s strong domestic market and minimum export dependence conditions are favorable to face adverse effects from Trim’s tariffs and global trade disruptions.“India is better than many other emerging markets to deal with tariffs and global trade disruptions in India, which help by strong internal development drivers, a large -scale domestic economy and low dependence on the trade of goods,” says it.The comprehensive tariff modifications declared by Trump on 2 April mark the most tariff growth since the 1930s. The mutual tariff scheme initially implemented an additional 26% duty on Indian exports to the US.Also read The first phase of the Indo-US trade deal before July; India wants complete discount from Donald Trump’s 26% tariff on some goods: ReportSubsequently, on 9 April, the Trump administration established a 90-day stagnation on the implementation of most tariffs, establishing a similar 10% rate for almost all targeted countries.The US is estimated to ban global economic development in collaboration with 10% universal tariffs in collaboration with 30% of duties on Chinese exports. It can reduce India’s GDP growth from 6.7% to 6.3% in the year 2025. Nevertheless, India will still remain the highest country among the G20 countries, notes Moody’s.What does India work in favor? Moody tells1. India’s economic growth is made up of domestic consumption, even the risk in American policy changes. Government spending on infrastructure contributes to GDP growth, complements by low personal taxation that encourages expenses, notes moody’s. 2. India’s slight dependence on goods trade and strong service industry provides protection against American tariff effects. India faces minimal direct impact from trade stress. Although the United States remains India’s primary export market, India’s impact on economic growth is limited, Moody’s says. This is due to temporary relief measures and comparatively low dependence on goods export relative to India’s other Asia-Pacific emerging economies.

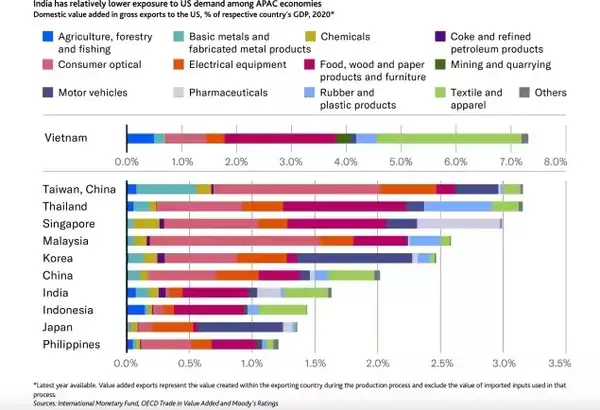

There is a relatively low risk for American demand between APAC countries in India (Moody’s)

3. Indian products can benefit from potentially increased American procurement if interaction compared to other developing countries results in preferential tariff treatment.4. The growth of the infrastructure sector is intensifying through continuous investment. Continuous requirements in power generation, transport networks and digital systems continue to attract adequate capital commitments in the next 5-7 years. American trade measures expect limited impact on most infrastructure segments due to primary attention to domestic market requirements.5. The local market focus provides insulation to non-financial enterprises with focus tariff effects. The expansion of infrastructure with positive population mobility supports the operation of Indian non-financial companies. Notable government capital allocation strengthens various fields including construction, resource extraction and industrial production.6. India’s banking industry displays flexibility against potential market volatility. Indian banks demonstrate strong financial health through strong profit and capital reserves.Also read Benefits for India: How to get Indian ports from China +1 strategy – Moody’s explains7. In May 2025, India and the UK finalized a comprehensive free-trade agreement after comprehensive talks. The agreement indicates a change towards trade openness as a strategic response to American tariff measures, unlike India’s traditional protective trade trend. Concurrent interactions with the European Union for a uniform FTA continue to concentrate with the US on reducing the punitive tariffs applicable in April.8. India’s demographic benefit contributes significantly to its economic development. The sufficient young population of the country increased the tendency of both individual needs and their offspring, unlike generations. The extended consumer credit industry further strengthens this consumption pattern.negative, Some industries face current or upcoming region-specific tariffs. The United States has imposed 25% tax on imported vehicles, automobile components, steel and aluminum, affecting companies in these industries negatively., Most Indian firms rated by Moody in these areas have a minimum direct US market risk or adequate domestic operations to manage the impact, various supply networks and sufficient safety measures including US-based features. Nevertheless, they remain susceptible to disruption of trade flow and increase in potential regional supply, especially from China.

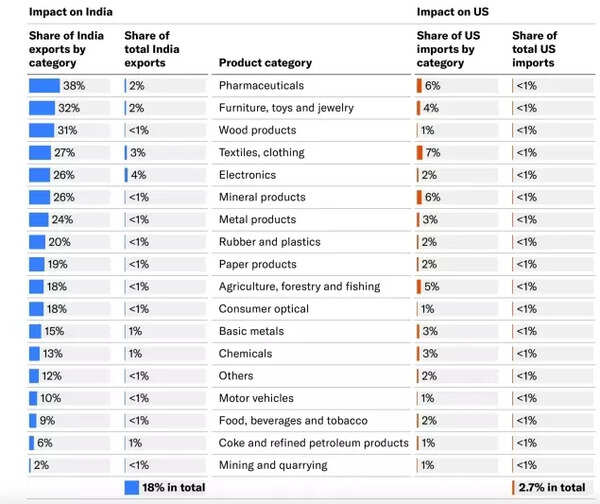

American goods were made aware of American tariffs based on 2024 trade data (Moody’s)

* In addition, the Trump administration is considering tariffs on additional areas, including pharmaceuticals, which represents one of the largest export categories of India for the US, unless the business talks between the two nations produce adequate results.* Although the tariff is not directly affected by tariffs, business service organizations face risks from American immigration policy changes. More rigorous American immigration rules will reduce the availability of the workforce and restrict the operation of Indian service providers who deploy their employees in the US. Despite the service firms gradually increasing local American recruitment, many are still dependent on the H1B visa workers skilled for extended American assignments, which weakened to increase immigration policy modifications and operational costs.Also read Why Apple will not be easy for us to transfer iPhone production from IndiaLong -term benefits indiaMoody’s approach is that high tariffs will run the supply chain relaying near the final-consumer markets. India stands to benefit the current below trend in foreign direct investment that targets its sufficient and expanded market.Over the long term, US tariffs on emerging economies such as China, Vietnam, Thailand and Cambodia have increased, which offer opportunities to increase their US market share in textiles, apparel, shoes and electronics exports for India.The growth of labor-intensive manufacturing sectors will contribute to employment generation.The electronics industry’s ability to capitalize on the ongoing supply chain changes will rely on business and investment policy adjustment that enables cross -cross -border movement of intermediate products to promote regional connectivity. To apply it just…How India -American trade deal will work, someone estimates – discussion is going on and analysts hope that a mutually beneficial deal will come soon. Reports suggest that the three-phase deal works, the first phase is likely to be finalized before July, which is around the time when the time limit of tariff poses ends 90 days.Meanwhile, India is ready to overtake Japan this year to become the fourth largest economy in the world. In the coming years, it will become the third largest after the United States and China. As experts accept globally, the greatest strength of the Indian economy lies in its fundamentally domestic development story. As it seems to increase export stake in its GDP, trade deals with countries other than the US will also play an important role.Additionally, a relative tariff profit on major economies like China, eventually can work in favor of India with the Chinese +1 strategy that expands supply chains in India in the world.Also read Profit or disadvantage? How will America -China trade deal affect India – explained