Are you saving enough for retirement? Are not many

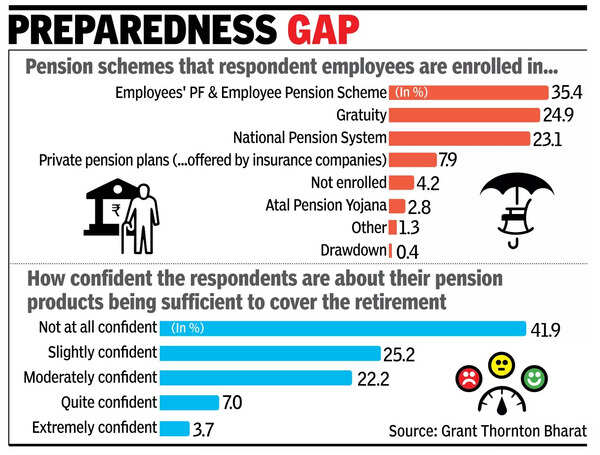

New Delhi: High -grossing retirement products contribute more, but the overall contribution to most individuals is still relatively low, suggesting that many people cannot save enough for retirement, shown in a survey on Wednesday.Around 83% of the participants really rely on three retirement products: EPF, gratuity and NP. “This dependence on traditional schemes suggests limited diversification in retirement departments,” a survey conducted by the counseling firm Grant Thorrton India.

The results showed that more than half (55%) of respondents are expected to be more than Rs 1 lakh. However, only 11% believe that their current investment is sufficient to meet these expectations. The report stated, “This Stark inequality highlights the difference of an important preparation that needs to be addressed through better financial planning and awareness,” the report states that the survey was operated by the consulting firm in August last year and sept for the survey.Government-supported schemes remain the most preferred option, in which 39% of the participants are in favor of such schemes. About 27% of the respondents showed a priority for private schemes offered by reputed financial institutions. High-risk, high-Return schemes were particularly popular among young respondents, with 31% of the age of 25, interested in these options. “This discovery suggests rising hunger for risk between young demographic,” the report states.With respect to the age of retirement, about 56% of the respondents stated that they plan to retire between 55 and 65 years of age. “This age limit aligns with standard retirement practices in India and reflects extensive social norms about work and retirement in the country,” according to the report. Young respondents, especially those who were 25 years or below, preferred early retirement. Among this group, 43% showed priority to retiring between 45–55 years. The report states, “The trend indicates a change in the approach among young employees, which can prefer work-life balance and holiday on the expanded career span.”74% of the respondents said that they contribute between 1% and 15% of their salary towards retirement plans. “This contribution indicates a cautious approach to border savings, probably influenced by financial obstacles or competitive priorities,” the report said. Asked to answer his knowledge about pension calculation, 52% of the respondents said that they know to some extent how their pension is determined, while 30% are admitted to be completely unknown.