Why IPO-Taiyar startups seek ‘confidential’ route

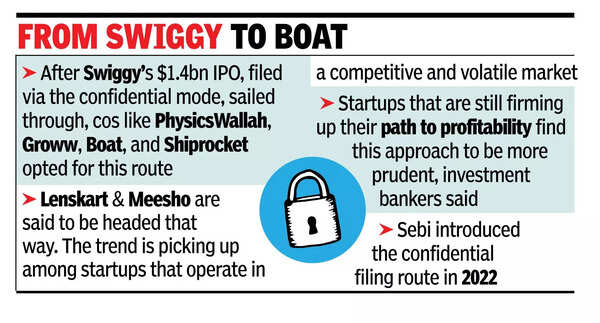

Mumbai: Startups preparing to go publicly are choosing rapidly for confidential IPO filing route.Last year, after Swiggi’s $ 1.4 billion IPO, was filed via confidential mode, was dispatched through, a clutch of firms, including Physicswallah, Grove, Boat, and Shiprocket, has taken the route. Sources said that Lenskart and Misho are also moving forward in this way. While traditional companies like Vishal Mega Mart have opted for this mode, and recently, Tata Capital opted to go confidential, the trend is picking up between a competitive market working startups.For one, a confidential filing startups allow their business metrics and performance to be kept away from the public eye. It also gives them a levery to test the market hunger and accordingly the IPO decides on time. Investment bankers said that this approach seems more prudent for startups that are still firm for profitability.

“This trend has been raised by startups that are in very competitive businesses as it helps them to mold the public manifestation of their KPI and other sensitive business information such as customers and vendors. It can also be useful in cases where issuers have a long -term time limit for IPOs, yet in the form of ANIR. Co, told toi. The first batch of the Big Startup IPO was seen in 2021, when the leadership of the epidemic for digital services increased, companies reached the markets to capitalize on consumer spirit. SEBI introduced the confidential filing route in 2022. An executive in an IPO-bound startup said, “Intensive market competition companies prefer small windows for the story fight in the public category. Information has been spent less time on wars, which is better for companies focused on manic growth and execution.”Zepto, PhonePe, Pine Labs, and Lenskart are among a startups that are eyeing a public listing. In an unstable market, the option of confidential filing becomes more preferred. Prakash Bulsu, the joint CEO of IIFL Capital, said, “By destabilizing equity markets with global rate cycles and bhurological risks, startups prefer to take into account their listing ambitions. This route allows them to be prepared, monitored and kill the market quickly, when Windows opens.”The practice of confidential filing is in developed courts, and adopts in India gives more flexibility to the issuance, Kailash Soni said Kailash Soni, head of India Equity Capital Markets in Goldman Sachs.“Companies are choosing to focus on investor marketing after recurring their strategies and receiving SEBI approval of SEBI’s Equity Capital Markets, MD and Head of Equity Capital Markets, Avendus Capital. This has helped the issuers consult with SEBI for ideas on regulatory issues and tested water from an evaluation perspective, said by JSA partner Arca Mukarji.