Paywall: UPI outage hits users across the country. Bharat News

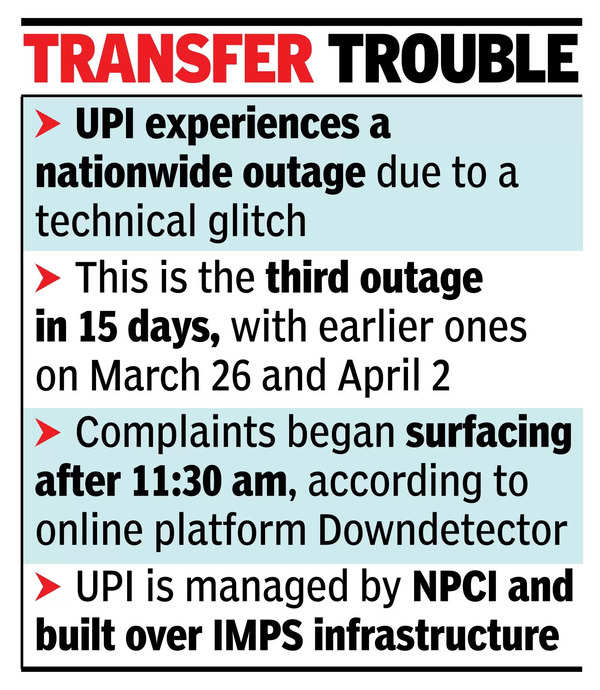

Mumbai: India experienced flip side of being cashless Integrated payment interface (UPI), the forum that is responsible for more than four-fiveth of all Digital transaction In the country, on Saturday, a major outage faced, causing the users struggling to pay in malls, parking sites and shops.

Users across India reported failed payment. Some received a debit alert despite unsuccessful transactions. The National Payments Corporation of India, which operates UPI, reported “leading technical issues leading to the decline in partial transactions”, which “stabilized by late noon”. News network

NPCI Said that he regretted the outage and “working to solve the issue”. Its influence was Pan-India with complaints from people in Bengal, Delhi, Maharashtra, UP, Gujarat, Uttarakhand, Assam and Southern states. A woman from the national capital said that the outage inconvenienced people in a special hospital as it led to a long queue at the payment desk. In Lucknow, the popular food chain Red Dragon operator, Ahad Arshad, said that about 50 customers were unable to pay their bills. He said, “We had to note their contact numbers for payment later. It was chaotic for about 25 minutes, but eventually all arrears were sanctioned,” he said.

Payment providers said that they started facing increased failures before 10 am. There was no shutdown of services, but there was a sharp increase in unsuccessful transactions. The success rate later improved in the afternoon. NPCI did not give any details of the cause of failures nor about the increase in failure rate.

Sources said it was not a capacity issue as NPCI was used in large quantities. The corporation was doing a “basic cause analysis” and did not disclose the reasons behind the dissolution.

The owner of an Ahmedabad -based petrol pump, requesting oblivion, said he turned into precautionary payment methods during the disruption. “We paid UPI before filling fuel or requested customers to use other options.” In UP, from restaurants to retailers, users from across the state reported that popular third-party payment platforms such as Google P, PhonePe and Paytm were unique between 11.20am and 11.45AM.

The disintegration was the fourth in 30 days – an unusual frequency for a platform with a highly reliable track record. Since its launch in 2016, UPI has scored fast without major hiccups. Ease of use-It has made it omnipresent, from vendors of a cost of a cost-to-cum-transfer of a cost to high value transactions, from vendors to high-value transactions. Many consumers are now accustomed to its dependence, no longer cash.

For small traders, outage meant missed sales. Customers of large retailers switch to more expensive card-based payments, increasing the cost of transactions.

This effect was in the fare of rickshaws ranging from a few rupees to petrol stations and shops. Earlier, on March 26, the disruption was also held responsible for a technical issue. Banks said that on 31 March and 2 April, outages were due to heavy traffic close to the financial year.

The last time UPI suffered a systemic vulnerability, when Yas Bank was in 2020, a major service provider for apps like PhonePs, was placed by the RBI under the ban. Fallout led the NPCI, which proposes a market-share cap to reduce single-binds-failure risks. Despite these efforts, Google Pay and PhonePe UPI dominate the ecosystem. Although transactions feel instantaneous for users, this process includes the third-party apps, their banks, customers and recipient banks and recipient payments and recipient payment processors and about 10 rapid-fire digital handshakes between the processor and their banks.

(With input from our state bureau)