‘US investor, Middle East interest …’: Holdings of Adani airport can increase $ 1 billion in equity; First time from external investor

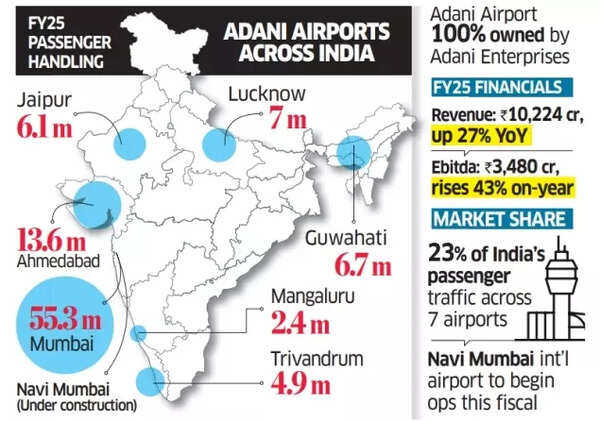

Adani Group CFO Jugeshinder Singh said that Adani Airport Holdings Limited (AAHL) is considering equity of about $ 1 billion from international investors, while assessing expansion strategies and potential acquisitions, Adani Group CFO Jugeshinder Singh has said. The airport enterprise will demand an external investor equity funding for the first time.According to sources quoted in the ET report, the estimated value of the Airport Division, which is fully owned by Adani Enterprises Limited, is $ 20 billion. The evaluation exceeds the GMR airport’s market capitalization of $ 10.4 billion. GMR operates airports at various places including New Delhi, Hyderabad, Goa and Nagpur.Aahl, which holds the position of operator of India’s largest private airport, currently manages seven airports – Mumbai, Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati and Thiruvananthapuram. The company is completing its eighth airport in Navi Mumbai, which started operating in August.Adani Airport holdings seek international investorsSagar Adani, nephew of the group president Gautam Adani, said, “Everyone wants to do the airport with us – the US, the Middle East and Australia investors have created interest in investing in business.” Sagar Adani is also an executive director, Adani Green Energy.Careedge rating estimates that India’s air passenger traffic will grow at 9% CAGR between FY25 and FY27, which will reach a volume of 485 million.

Adani Airport across India

According to the Directorate General of Civil Aviation, India’s domestic air passenger traffic saw an annual growth of 10.35% in FY 25. Airlines took 14.54 million passengers on their routes.Aahl plans to capitalize on this development by expanding its infrastructure, especially with airports in Mumbai-Navi Mumbai and other strategic places, targeting its capacity in the next 15 years.Also read Big concern! China’s hold on rare earth magnets sends the Indian auto industry to a spin; People of the industry visited China delegationWhile the company currently maintains sufficient funds, it is open to achieve additional capital based on time and market conditions.Adani CFO Singh, indicating uncertainty about his immediate plans, said, “We have not even decided whether we want to do it or not. So what we are thinking is-whether it is a good idea for us right now or we should wait for two-three years for us for two-three years.In January, Abu Dhabi Investment Authority (Adia) gave an investment of 6,300 crores to GMR Enterprises (GEPL), the GMR Group’s promoter unit, to reduce the burden of their debt.Regarding the expansion plans, Singh said, “We are open to India and internationally. For international deals, it will be an international city pair that completes an Indian migrant. If many Indian travelers are going to a specific airport in another city of the world, and if that opportunity comes up, we will look at it.”The organization plans to establish the airport business as an independent assistant within the next two-three years, before proceeding with its list.AAHL reported an increase of 7% in passenger traffic, handling 94 million passengers in FY25 compared to FY24.Also read ‘Better than America …’: Nitin Gadkari has claimed India’s roads to be comparable with us in 2 years, ‘The main picture still adds’ to start’.