Trump’s tariff: big American business, stock hit big

Mumbai: Shares of big risky companies in the US market are being sold aggressively by investors as market players are afraid of recession in the world’s largest economy and growth in businesses globally. Economists and market strategists believe that high import duty by the US may motivate other countries to retaliate with similar measures, which in turn can cause global recession in production, causing damage to almost every country.

In the Indian market, companies from areas such as auto and auto parts, metals, software, pharma, textile and gems and jewelery have seen their stock prices fast.

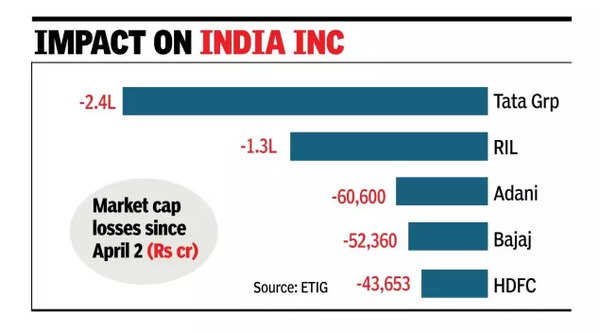

Among major groups, the Tata Group has seen the most market capitalization, with a major risk to the US market as new tariff proposals were announced in the end of April 2. The group’s market cap is less than Rs 2.4 lakh crore to Rs 25.5 lakh crore. This is followed by Reliance Industries Group led by Mukesh Ambani, which has lost a market price of about Rs 1.3 lakh crore.

In Tata group companies, the market cap of flagship TCS has fallen by around Rs 97,100 crore; Tata Motors, which is a major risk to the US market through its international ARM JLR, has lost a market price of about Rs 33,800 crore. The current celloff among IT exporters is mainly on the back of apprehensions that is a recession in the US, which is the largest market. Software exportTheir income and profit can hit. The largest market between companies is Cap Los Reliance Industries (Rs 1.1 lakh crore).

In metal companies, Tata Steel has lost a market cap of about Rs 31,300 crore, while Hindalco has lost a market price of about Rs 22,200 crore. Analysts of the sector said that metal stocks are down on the apprehensions that would reduce the demand for metals by a global recession or recession. In Monday’s market, six of the 30 Sensx components hit the 52-week lower levels: Infosys, L&T, RIL, Tata Motors, TCS and Titan. And among the BSE 100 components, 22 shares reached a low level of 52-week as 22 shares.